Personal Financial Planning In The Wake Of COVID-19

Time to Re-Focus on Basic Needs

Introduction

In recent years, we have all had to deal with unimagined threats to our physical and financial health. The 2008 financial crisis lead us to focus on prudent asset management; and then, after enjoying 10+ years of extraordinary equity market growth, the COVID-19 Pandemic reminded how fragile our health and the economy can be.

As a result, it may be a good time to re-think the risk management measures we have in place with respect to the financial security of our families, our investment portfolios and the threats to the value of business interests.

Specifically, to reconsider the:

- adequacy of liquid resources,

- investment risk tolerance,

- security of retirement savings,

- exposure to tax rate risk,

- adequacy of life, disability and long-term care insurance coverages and,

- plans in place to protect the value of business interests.

Tax Risks

Tax planning is an important component of risk management with respect to invested assets, retirement savings and any plans for transferring business interests. In a recent opinion piece in the Wall Street Journal, Philip DeMuth, the well-known investment advisor and author of several investment books, pointed out that we are currently living in a “Golden Age of Taxes – the lowest rates we may see for decades.” He goes on to summarize the potential tax increases that we could see in the not too distant future to offset the extraordinary economic stimulus spending of 2020. For example, the scheduled 2026 “sunsetting” of many of the tax benefits of the 2017 Tax Cuts and Jobs Act might be accelerated resulting in increases in individual and corporate tax rates, a reemergence of the AMT, reversal of the doubling of the federal estate tax exemption and an increase in capital gain rates and social security taxes.

He concludes the piece by suggesting, “the smart move for high earners is to play defense. Contribute to an after-tax 401(k) plan and convert your traditional IRA to a Roth. That way, you pay the taxes at today’s lower rates.”

One More Idea!

One option Mr. DeMuth failed to mention as an effective hedge against future tax increases is a life insurance-based supplemental retirement plan; a concept that has been around for many years, but which is much improved in recent years with the introduction of a wide range of competitive products.

In comparison to life insurance-based plans of years past, a contemporary program can provide competitive pricing, the flexibility to meet specific individual and/or business needs and a greater range of potential benefits. The matrix on the following page provides a comparative analysis of the key characteristics of personal after-tax savings in a mutual fund portfolio versus a contemporary life insurance-based plan.

| KEY CHARACTERISTICS | ||

| Characteristic | Mutual Fund Portfolio | Life Insurance-Based Savings Plan |

| Taxation | · After-tax contributions · Partially tax-deferred accumulation · Taxable reallocation / rebalancing · Taxable distributions at blended ordinary / capital gain rates |

“Roth-Like” tax characteristics: – After-tax contributions – Tax-deferred accumulation – Tax-free reallocation / rebalancing – Non-taxable distributions (if properly structured) |

| Investment Options | · A wide range of individual funds · Model portfolio options |

· A wide range of individual funds · Model portfolio options · Equity index funds with downside protection |

| Contribution / Distribution Flexibility | · Complete flexibility, subject to tax and liquidity considerations | · Contribution flexibility, subject to possible underwriting considerations · Non-taxable withdrawals at any time |

| Liquidity | · Ranges from complete to limited, depending on asset class · Possibly limited by tax considerations |

· Access to policy cash value at any time through non-taxable withdrawals and loans |

| Security | · Complete control through asset ownership (unless restricted by trust, if used) · Fully portable |

· Complete control through asset ownership · Fully portable |

| Other Features / Benefits – Personal | · Transfers of partial interests possible, if desired | · Features designed to maximize non-taxable withdrawals while limiting tax risks. · Optional long-term care benefits · Significant estate planning flexibility |

| Other Features / Benefits – Business | · Diversification of net worth: An opportunity to build assets outside business | · Diversification of net worth: An opportunity to build assets outside of business · May facilitate business succession planning, and protection of business value |

| Risks / Issues | · Credit risk of investment / asset manager · Market / interest rate risk · Net Investment Income surtax (3.8%) · Risk of adverse changes in tax law |

· Insurance company credit risk – In some, but not all, cases · Market / interest rate risk – Offset by downside protection in equity index products · Potential impact of underwriting · Risk of adverse changes in tax law |

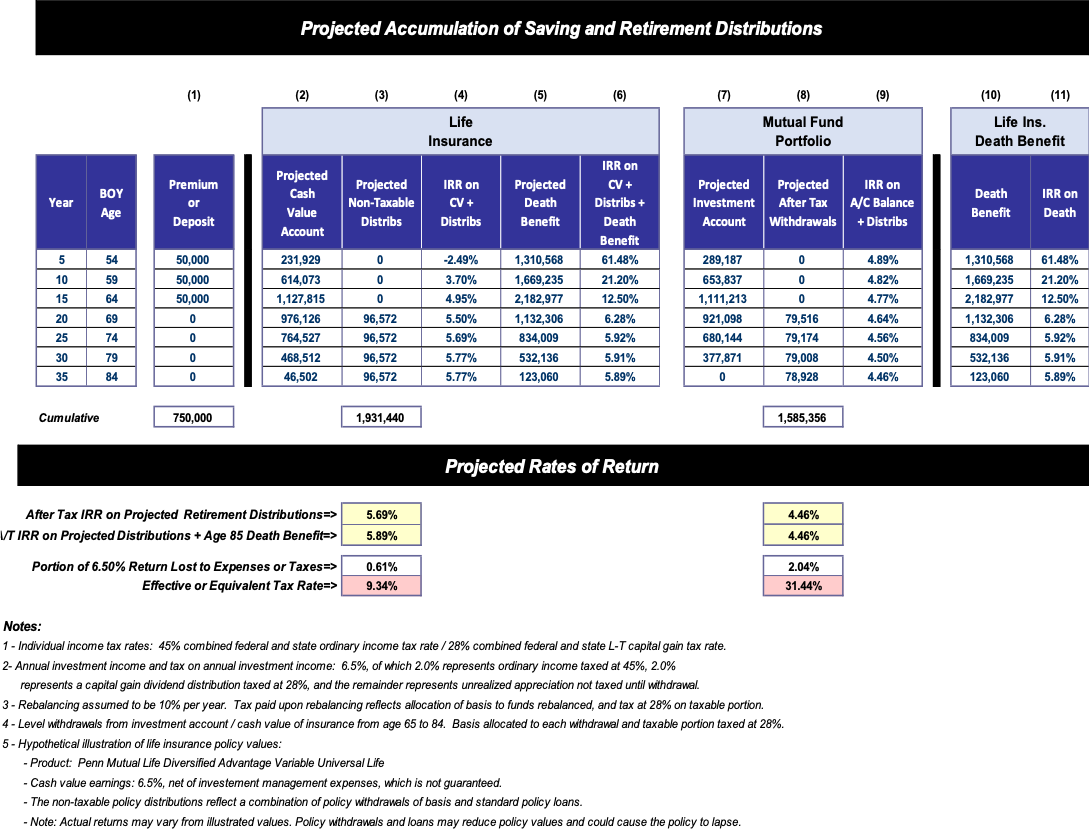

Comparative IRR: Life Insurance vs. Mutual Fund Portfolio

The following is a hypothetical analysis of the internal rates of return from an investment in a contemporary variable universal life insurance (VUL) contract versus a portfolio of mutual funds. The assumptions on which the analysis is based are included below.

Observations:

- The projected after-tax IRR in the short-term is better with a mutual fund portfolio because of the up-front loads and expenses associated with the VUL contract (see the following page for a comparative analysis of expenses)

- However, over the long term, the projected after-tax IRR of the VUL contact (with or without consideration of the death benefit) is superior to that for the mutual fund portfolio.

- A contemporary life insurance-based supplemental retirement plan providing a combination of tax-advantaged savings, protection against future tax increases and cost-effective insurance coverages could be a valuable component to your personal financial plan.

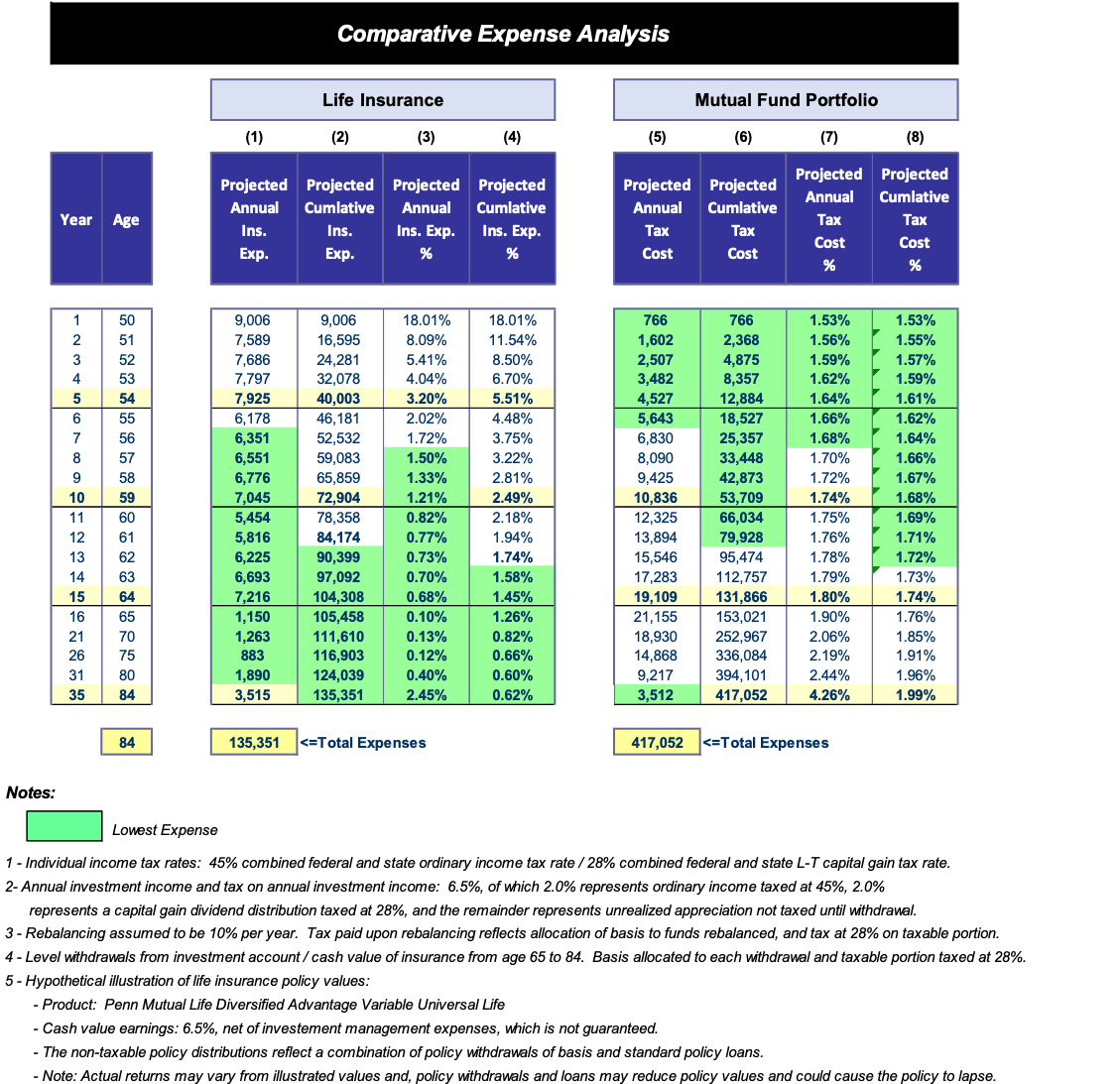

Expense Comparison

The following is an analysis of the projected loads and expenses of the hypothetical VUL contract in comparison to the projected tax cost of the hypothetical mutual fund investment. The comparative advantage is highlighted in green.

Observations:

- The projected tax costs of the mutual fund portfolio are less than the projected loads and expenses of the VUL contract in the early years; but,

- When viewed from a long-term perspective, the VUL contract may represent a more cost-efficient savings vehicle, and it provides a number of additional financial planning / risk management benefits.

In Summary

If it is time to re-think your personal financial plans and risk management measures, consider including a contemporary life insurance-based supplemental retirement plan in the mix. A well designed and properly administered program may represent a valuable addition to your long-term financial plans, providing:

- Tax-advantaged liquid savings

- A hedge against future tax increases,

- A significant death benefit (and optional chronic illness benefits),

- Protection of the value of business interests and,

- Professional management, essential to maximizing benefits and minimizing tax risks.

For more information about how EBS could help in this regard, simply contact Chris Rich (617-904-9444 x2) who wrote this blog.

P.S. If you’re a participant in a Deferred Compensation Plan, take a look at Bill MacDonald’s post before this that addresses the ability to take distributions from nonqualified plans.