Is Your “Total” Rewards Program Out of Balance?

One-quarter of respondents to a recent survey of some 100 companies cited an uptick in turnover of senior-level executives in the past six months, with about one-third of those claiming it’s because of a better economy and improved job market, says the Boston-based outplacement firm, Clear Rock.

When the Minneapolis-St. Paul Business Journal queried a group of executive search firms on turnover, most agreed with Brian Carlson, president of Ambrion, Inc when he was asked:

Do you see more senior-level executives looking to switch jobs or employers now that the economy is picking up?

“Absolutely. For the past five years people have been happy to have a job. We are now seeing the CFOs [chief financial officers] and controllers we work with wanting more in the next position. This could be a bigger company, bigger team, better growth potential or more exciting industry. Executives definitely feel empowered to move their careers forward now that the employment market has improved.”

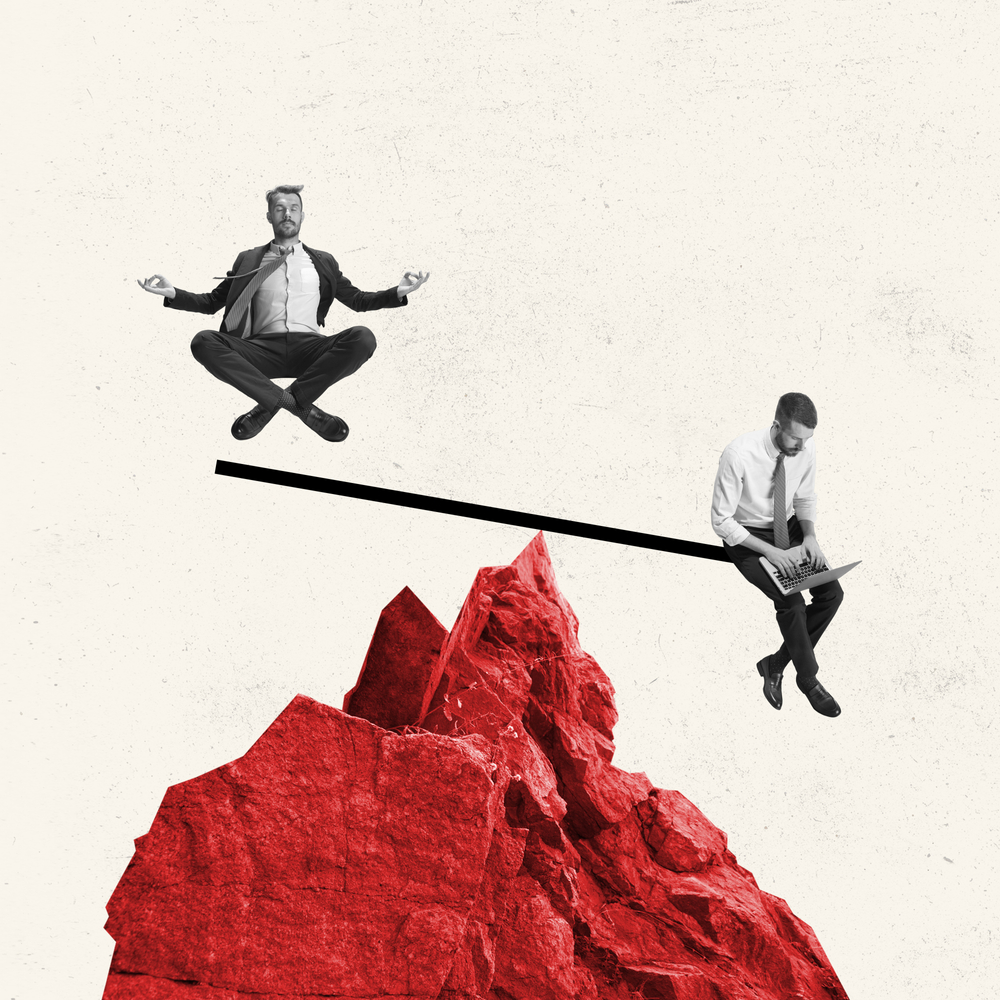

Can your firm afford to lose its prized performers? Of course not. But that’s what may happen if you don’t balance your executive compensation with your executive benefits package.

WHAT YOU CAN OFFER

Today’s qualified executives hold more negotiating power. They know they can command high salaries and lucrative severance packages. Right-minded executives who are builders, creators, collaborators, and true leaders will likely be influenced by a different or challenging opportunity. But a highly attractive rewards package can and does tip the scales in multiple offers. So what do you offer?

There are as many combinations of comp and benefit programs as there are executives to enjoy them. Equity instead of cash. Cash. Deferred comp. Performance incentives. Life insurance. And on the softer side―Everything from signing bonuses, high-end club memberships, corporate cars or drivers to relocation costs, time-off, and whatever else creative compensation committees can devise.

THE DILEMMA

For the last ten years, the stock market has been flat, as we all know. Widespread layoffs, hiring freezes, offshoring, competition, rising cost of materials have shaken productivity and profitability. Many stock plans are underwater. Companies see this change as an opportunity to refine and optimize their total compensation to search for more cost-effective alternatives to win shareholder confidence. In short, the harder the economic times, corporate leaders require better compensation packages.

Please ask yourselves:

- How does one determine what packages of benefits are best-suited for a given company?

- Which benefits are truly necessary and aligned with overall executive compensation philosophy? Which benefits are likely to add value to shareholders?

Download our latest White Paper: “How Executive Benefits Enhance Executive Compensation Programs— Cost-Effective Benefit Programs Provide Win-Win Outcomes for Executives and Shareholders,” where we answer these questions, as well as outline a six-step process for bringing compensation and benefits into balance.