In this info-packed presentation, you will learn how the phantom stock option fills the recruitment void for private companies hard-pressed to compete with major corporations in the recruit/retain/reward challenge.

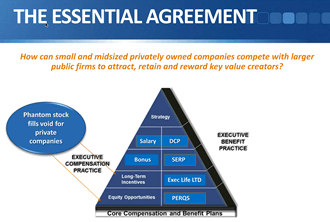

Large companies are able to attract top performers with generous benefits and long-term equity. Mid-market private companies are often limited to the allure of innovative cultures and the promise of an IPO.

In this presentation, we’ll show you how to use a phantom stock plan to transform key employees into thinking like owners. When properly incentivized, employees drive performance, values align with corporate objectives, and ownership becomes leadership.

A look inside, The Exquisite Reality of Phantom Stock:

Marketplace Overview

The Essential Agreement

What is Phantom Stock?

Phantom Stock Plan Structure

The Rationale for a Phantom Stock Plan

Developing the Plan Concept and Budget

Developing the Plan Purpose

Forecast Future Company Value

Three Types of Plans

– Full Value Phantom Stock Plan

– Performance Phantom Share Plan

– Phantom Stock Option Plan

Phantom Stock Plan Design Decisions

– Redemptions/Distributions

– Control Over Timing of Distributions

– Valuation

– Participants

– Allocation of Value & Awarding of Grants

– Dividends

– Vesting Schedule

Funding the Phantom Stock Plan

Case Study 1: Software Development Firm

Case Study 2: Medical Research

Phantom Stock Plan Implementation Steps

About EBS

Disclosures

Take a few minutes out of your busy schedule to view this phantom stock presentation. It’s a win-win for you and your employees.

P.S. For more on Phantom Stock Plans check out our white paper, The Alchemy of Ownership – Use Phantom Stock Plans to Improve Retention and Grow Revenue.