Stock options lost some of their appeal when the FASB required expense recognition. In their place, Restricted Stock has risen in popularity. And it’s easy to understand why. From a shareholder’s perspective, Restricted Stock offers a significant benefit: it is extremely effective at motivating key employees to think and act like owners.

When a restricted stock award vests, the employee or director who received the restricted stock becomes an owner of the company. But this comes with a significant tax cost, which could be deferred. We discuss how to do this in our latest brochure, “Restricted Stock Units (RSUs) in a Nonqualified Deferred Compensation Plan—An Effective Tax Planning Tool for Future Financial Needs.”

Importantly, if an employee departs before the vesting period lapses, then he forfeits the stock. This glue-in-the-seat effect helps company’s hold on to their best people.

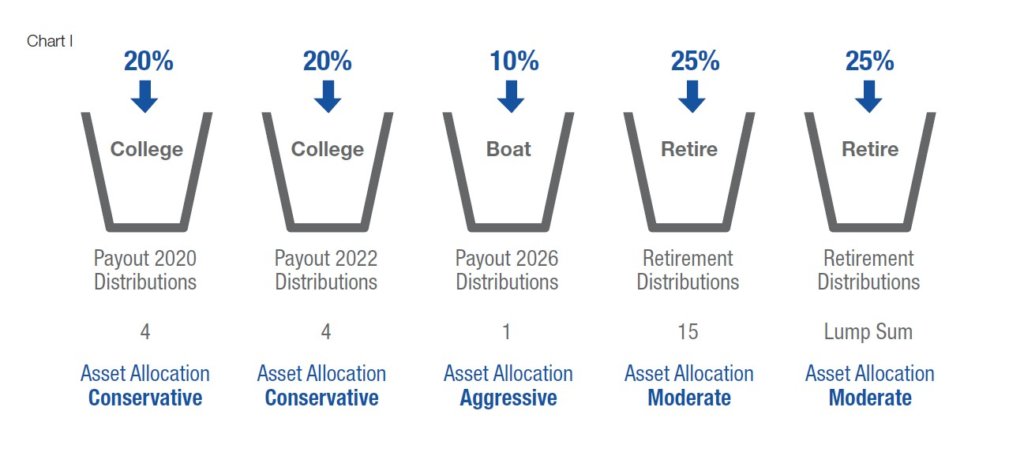

With the issuance of RSUs as part of a total rewards program and the need for advanced tax planning in these uncertain times, NQDC plans with this feature, as well as the flexibility discussed above in Chart I, should be a win-win for executives, outside directors, and the company shareholders. Favorable accounting also makes this an attractive benefit for shareholders to attract, retain and reward the key people who can make a difference in the organization.

And finally, having the right administrator to manage and communicate this feature could be the key in your success. There’s much more to learn about the impact of RSUs in your executive benefits program so download this brochure today and retain your best and brightest.