Restricted Stock Units & Performance Stock Units have replaced stock options as the most commonly used form of long-term equity compensation. They offer greater flexibility of plan design, potential tax advantages and simplified stock plan administration.

A disadvantage compared to stock options is the loss of control over the timing of taxation. RSUs/PSUs are subject to income tax upon vesting and distribution versus stock options which are taxable upon exercise. Executives can select the most favorable point during a 10-year window for exercise.

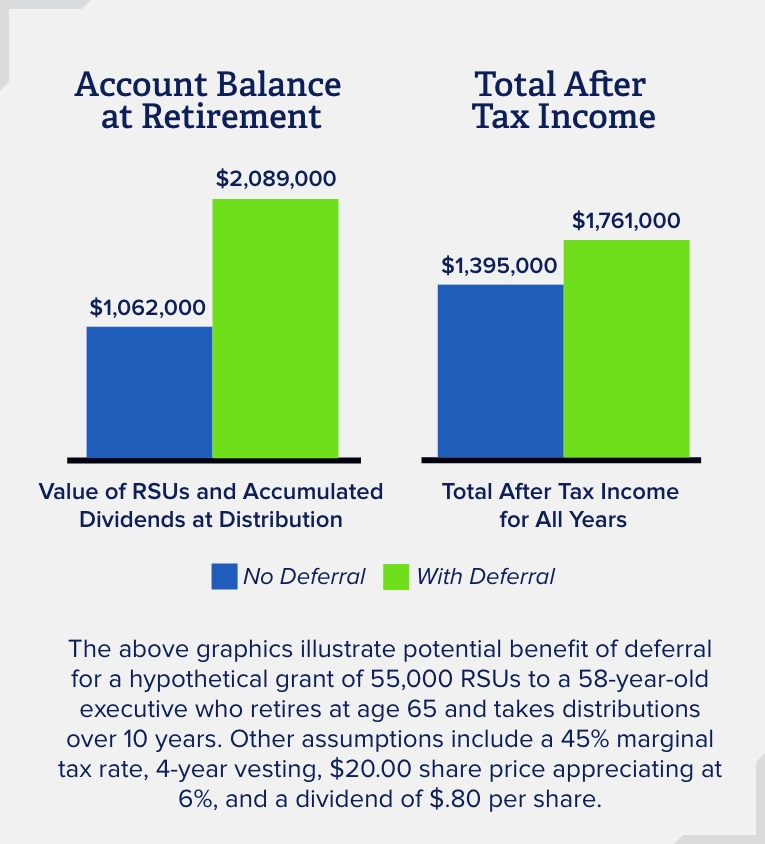

As a result, many companies have implemented a deferred compensation plan that allows the deferral of RSUs / PSUs upon vesting and thereby restores control over the timing of taxation. In addition, the plan can be designed to allow diversification without triggering taxation.

We’ve created our latest one-page guide, The Deferral and Diversification of RSUs and PSUs, to help you discover why so many major organizations are now allowing their key employees the ability to do just that, defer and diversify their RSUs and PSUs. Click below to access the guide today.

In our EBS guide you’ll learn about:

- The potential advantages of allowing the deferral and diversification of RSUs and PSUs

- The potential issues and risks associated with the deferral and diversification of restricted stock units and performance share units.

- and more!

How does the deferral and diversification of RSUs and PSUs apply to my organization?

EBS welcomes an opportunity to work with you to review the compensation and benefit programs offered to key employees and professionals for competitiveness, cost-effectiveness and, specifically, the ability to defer and diversify RSUs and PSUs.

EBS handles plan design, administrative platform comparison, enrollment, underwriting, and ongoing administration.