We designed the EBS Income Retirement Builder specifically with our nonprofit and private company clients in mind.

Privately held companies and nonprofit organizations face a unique set of barriers to executive compensation planning that our public company clients avoid. So how do we leverage the playing field for our private company and nonprofit clients looking to retain their key employees? We implement a tax advantaged and flexible alternative for their key people – The EBS Income Retirement Builder.

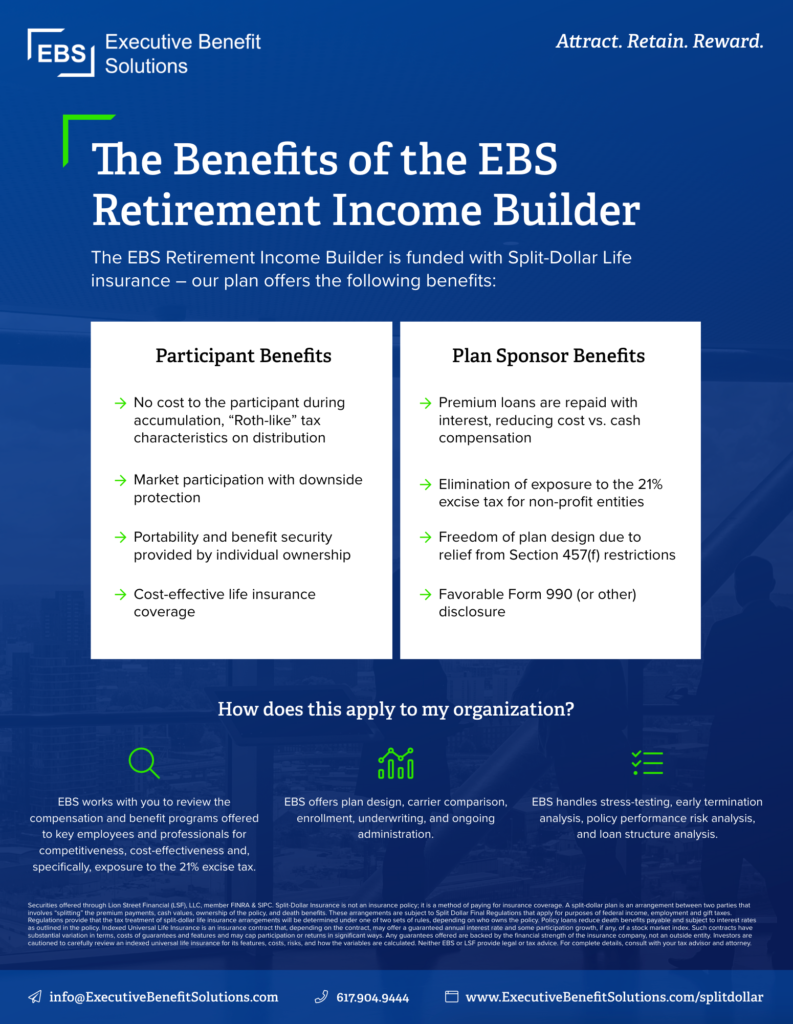

A plan built with one thing in mind – creating a flexible and tax-advantaged planning alternative for our nonprofit and private organization clients.

Participant Benefits

- No cost to the participant during accumulation, “Roth-like” tax characteristics on distribution

- Market participation with downside protection

- Portability and benefit security provided by individual ownership

- Cost-effective life insurance coverage

Plan Sponsor Benefits

- Premium loans are repaid with interest, reducing cost vs. cash compensation

- Elimination of exposure to the 21% excise tax for non-profit entities

- Freedom of plan design due to relief from Section 457(f) restrictions

- Favorable Form 990 (or other) disclosure

The EBS Income Retirement Builder plan is funded by Split Dollar Life Insurance. Take a moment to browse through our overview of the plan below. You’ll learn about the many benefits for both the participant and the plan sponsor.

How does a split dollar arrangement apply to my organization?

EBS welcomes an opportunity to work with you to review the compensation and benefit programs offered to key employees and professionals for competitiveness, cost-effectiveness and, specifically, exposure to the 21% excise tax.

EBS handles plan design, carrier comparison, enrollment, underwriting, and ongoing administration.