An Overview of Restricted Stock Units in a Nonqualified Deferred Compensation Plan

Why Use Restricted Stock Units?

Did You Know Restricted Stock Doubles as an Effective Tax Planning Tool for Future Financial Needs?

Restricted stock units have become a popular planning tool for many corporations because stock options themselves lost some of their luster when FASB required corporations to recognize an expense for their stock options.

A major advantage gained by using restricted stock units, at least from a shareholder’s perspective, is its effectiveness in motivating key employees to think and act like owners. When a restricted stock award vests, the employee (or director) who received the restricted stock becomes an owner of the company. And the employee or outside director has no further action to take to make it happen. The employee is now a shareholder and can vote at the annual meeting. Do know, however, this transformation carries a stiff tax cost, which we’ll discuss later.

For a comprehensive overview of the topics discussed in this blog, you can download our brochure entitled, “Restricted Stock Units (RSUs) in a Nonqualified Deferred Compensation Plan—An Effective Tax Planning Tool for Future Financial Needs.”

The normal restrictions on the stock are time restrictions, known as a vesting period. If an employee leaves the company before the vesting period lapses, then the employee forfeits the stock. This condition is a good way to retain the company’s key people. Once the vesting period is satisfied, the employee owns the stock and can sell or hold it. If the stock price at time of grant is high and then when the grant vests the price is lower, the employee still holds something of value.

Any award of restricted stock comes with a tax cost:

- The value of stock transferred to an employee is includible in employee’s gross income in the first taxable year in which the risk of forfeiture lapses (when they vest).

- Any grant of restricted stock is subject to an election to defer the income attributable to the grant until the employee’s rights in the stock vest when the risk of forfeiture lapses. However, the employee may elect under IRC Section 83(b) to recognize income at the time the stock is granted (potentially the lower price). Most executives don’t do this, as they are paying taxes on something they may never see (could leave the company before they vest).

- The advantage of accelerating income under §83(b) is that any future appreciation in the stock won’t be taxed to the employee until the stock is sold and is then subject to capital gain rates. However, as we mentioned above, most don’t do this for fear for paying tax on something they may never see the value of.

- If the §83(b) election is not made, on the date the restrictions lapse, the employee will be treated as receiving taxable income equal to the fair market value of the stock (presumably higher in price).

By way of example, if the employee makes an §83(b) election then the employee will receive taxable income in the election year. The amount of income will be the fair market value of the stock on the date the restricted award is granted.

Employee A is granted 1,000 shares in 2009 when the value is $100.00 a share and the restrictions on the stock lapse (they vest) in 2011 when the stock is worth $160.00 per share and the employee sells the shares in 2012 for $200.00 per share. If the §83(b) election is not made then the employee will be subject to ordinary income tax on $160,000 (1000 x $160.00 per share on the restriction lapse date) and capital gains tax on $40,000 when the stock is actually sold in 2012 (1000 x $200.00 with a tax basis of 1000 x $160.00 previously taxed).

If the §83(b) election had been made at date of grant then the employee would have been taxed on $100,000 (1000 x $100.00) as ordinary income and $100,000 capital gains when the stock was actually sold (1000 x $200.00 with a tax basis of 1000 x $100.00 previously taxed income). Under the §83(b) election more of the gain is subject to capital gains, therefore the employee has greater value for making the earlier election.

There are advantages to restricted stock but, as the examples illustrate, there are necessary steps an employee must take in order to avoid tax pitfalls and, under IRC Section 83(b), the employee could be paying tax on an asset the employee may never receive, or on an asset with a lower value in the future if the stock price declines.

THE BETTER ALTERNATIVE

In order to avoid the complexities of Restricted Stock, many companies now use Restricted Stock Units (RSUs) with the potential for further tax deferral into their nonqualified deferred compensation (NQDC) plan. The units are not issued in the form of actual stock. Instead, the RSUs are measured and valued against the company’s stock. Rather than issue stock with restrictions, the company issues restricted stock units with similar restrictions but with one major advantage: The entire value and taxation of the units may be deferred to a future date without an §83(b) election.

DEFER TO THE NQDC PLAN

Instead of paying tax when the RSUs vest, any units issued to an employee at the time of issuance may be deferred to a Nonqualified Deferred Compensation Plan (subject to the guidelines under IRC §409A, not discussed herein). The units’ value will grow inside the RSU plan and then later inside the deferred compensation plan without any current tax consequences to the employee. This deferral opportunity avoids the problem of an employee paying tax on phantom income under an §83(b) election, as well as avoiding the potential problem of an employee paying tax currently on an asset the employee might not receive because of a forfeiture event. What’s more, the employer may allow participants who defer RSUs to diversify some or all the units into a diversified portfolio of investment funds within the deferral plan.

By using a NQDC plan, you alleviate the tax-related complexities associated with restricted stock. The risk the employee faces with restricted stock units in a NQDC plan emerges if the company fails, then the plan could be subject to creditor claims. However, the employee would be in an even worse position with restricted stock because the employee would have already paid tax on a worthless asset.

In today’s environment where high-end talent is scarce and companies must retain key employees, a NQDC plan with restricted stock units solves the compensation goals of an employer to provide stock-related financial rewards. Furthermore, RSUs in an NQDC enhance retention and avoids unexpected and untoward tax consequences for the employee.

The value of the RSUs can be tracked through the normal operation of the employer’s NQDC plan recordkeeping service. These deferred stock awards eventually could become the cornerstone of the employee’s retirement plan. And, for that reason, they deliver priceless value as a recruiting and retention strategy.

When the employee first makes his election, which is required within a 30 day period of the grant being made, he or she can defer the award beyond the vesting period and take distribution many years in the future. With most NQDC plans, they can plan for their life events and defer the shares to help finance many of their life’s financial goals.

THE BUCKET COMPARISON

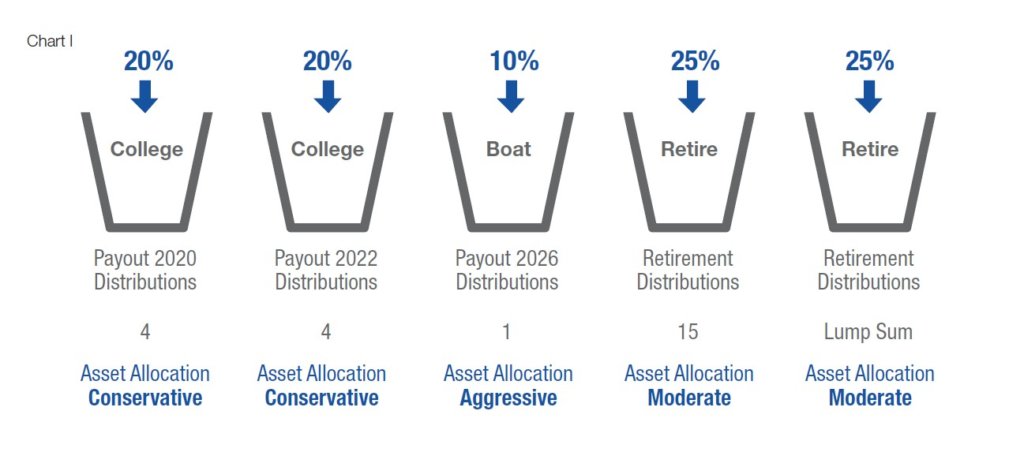

Chart I illustrates an example of a 45-year old executive with two children, ages 13 and 11. In 2009, he was issued 50,000 RSUs, with a three-year vesting period (1/3, 1/3, 1/3). By making his election within 30 days of grant, he deferred 20 percent of the shares (10,000) for his son’s college education starting in 2014 (first bucket) and 20 percent (10,000) to his daughter’s education starting in 2016 (second bucket).

He also made the election to take each bucket in four (4) equal installments, as he anticipates a four-year college education for both his children. The advantage, he is not paying taxes when he vests on the undistributed shares and he has the ability to continue to grow them tax deferred.

Now, continuing with our chart, he sets up another life event by deferring 10 percent (5,000 shares) into his “boat account” (third bucket). When the kids are out of school, he and his wife want to enjoy life a little. And finally, he makes two elections with the final shares and defers the balance until retirement, setting up two buckets. The first, he decided to take a lump sum so he can take a little money off the table at retirement and the second, he takes over a 15-year period with the growth of the stock appreciating tax deferred.

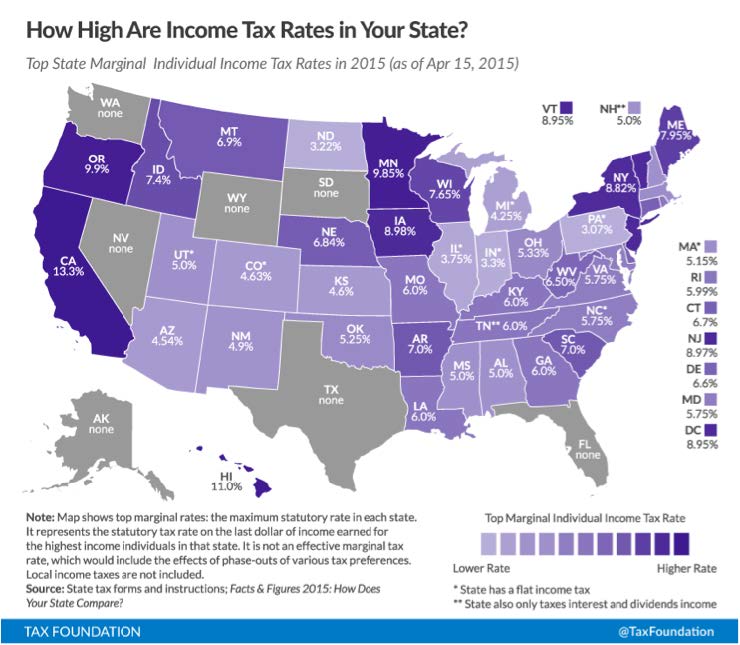

By taking the last bucket over 15 years, he also takes advantage of additional tax benefits. There are tax advantages for taking a distribution over ten years or longer, called the source tax provision. This provision allows the executive to defer while living in a high-income tax state like California or New York, and taking his deferral (10 years or longer) while living in a state without income tax, like Nevada or Florida. Nine states in America assess (Chart II) no income tax.

Think of yourself in this scenario. This provision could make a huge difference on the income you receive at retirement. It will be very important at retirement to plan your distributions not only in the form you take them, but where you take them.

Under the new §409A regulations for deferred compensation, the participant could even “re-defer” the previous election. As an example, if the child decides to not go to college immediately, or better yet she gets a scholarship, you can re-defer those dollars to later years.

Under the new §409A regulations for deferred compensation, the participant could even “re-defer” the previous election. As an example, if the child decides to not go to college immediately, or better yet she gets a scholarship, you can re-defer those dollars to later years.

The rules are quite clear: You need to elect to re-defer at least one year prior to distribution, and your re-deferral must be for at least five years. There is no restriction on how many buckets you can establish or how many times you re-defer. You could set up 5, 10, 15, or more distribution buckets, and have a cascading effect, rolling those RSUs to later dates while having the option to take them while you’re working to help settle life’s financial needs. You will have the same opportunities with future grants of RSUs, by adding to the existing buckets, or setting up new ones.

ACCOUNTING FOR THE DEFERRAL OF RESTRICTED STOCK UNITS

One of the most attractive aspects of the concept presented―there is no additional cost to the company. If the employee defers RSUs and the company settles in stock, the company can take advantage of favorable fixed accounting, making this plan attractive to both participants and shareholders.

All the details are spelled out in EITF 97-14. EITF 97-14 provides special rules for how Employer Stock is to be handled for purposes of both the NQDC plan and its funding. If such stock is used as a NQDC plan measurement fund, its accounting is the same as that for any other NQDC plan investment option using variable accounting; however, if the plan provides that (i) a participant may not allocate his or her account balance in and out of the NQDC plan Employer Stock account; and, (ii) the portion of his or her account balance that is allocated to Employer Stock can only be paid out in employer stock, then the Employer Stock is held at basis, without any increase or decrease in value due to gains or losses (“Fixed Accounting”).

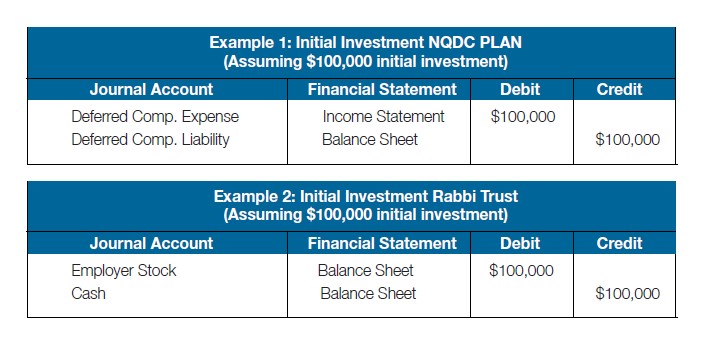

This Fixed Accounting is shown below. If Employer Stock is used to informally fund the NQDC plan liability through a Rabbi Trust, EITF 97-17 provides that such stock will be treated as treasury stock and held at basis.

A. INITIAL INVESTMENT

The initial investment in Employer Stock in the NQDC plan is shown in Example 1 and in the Rabbi Trust in Example 2.

B. EARNINGS

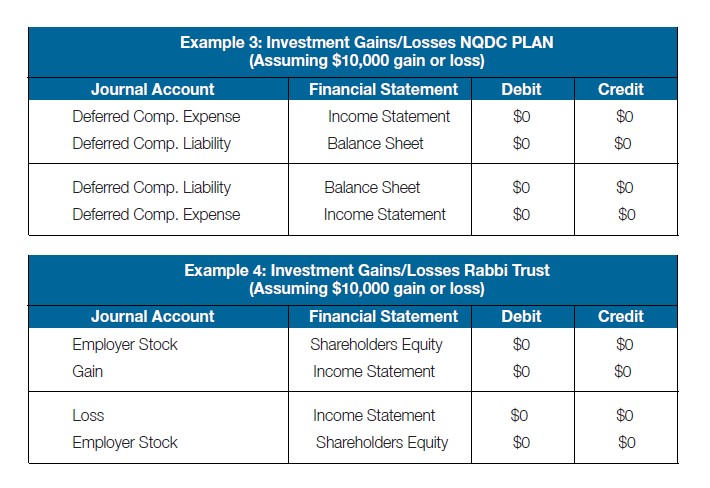

Assuming that liabilities are booked using the Fixed Accounting method, Example 3 shows sample entries for the NQDC plan. Example 4 shows sample entries for Employer Stock held in the Rabbi Trust. In both instances, no gain or loss is booked.

C. PAYMENT OF BENEFIT

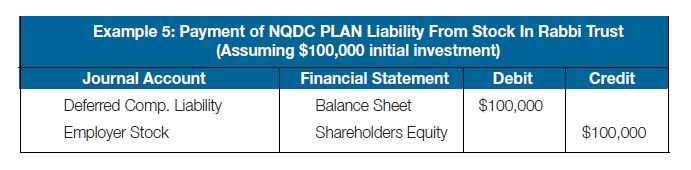

When Employer Stock is sold and the Fixed Accounting method is used, no realized gain or loss is recognized, as shown Example 5 below.

SUMMARY VIEW

With the issuance of RSUs as part of a total rewards program, and the looming need for advanced tax planning in these uncertain times, NQDC plans should be a win-win for executives, outside directors, and the company shareholders. Combine the tax deferral feature with the flexibility discussed in Chart I, add in favorable accounting and you create an innovative and attractive benefit for shareholders to recruit, retain and reward the key people who can make a difference in the organization.

Be sure the right administrator stands ready to manage and communicate this RSU feature. That’s the key to your success.

See you on the upside, Bill

For more on the use of restricted stock units (RSUs) in an equity compensation plan, you can read our series Executive Stock Wealth in the Age of Distraction.

Or, head on over to watch our RSU deferral and diversification video.