Comprehensive Guide to Executive Benefit Planning for Privately Held Companies

One of the most active executive compensation and benefits markets for EBS is working with privately held businesses. The following is a brief overview of the EBS planning process in general, and a review of certain representative case studies of planning engagements.

A Total Rewards Approach

Many privately-held businesses provide key employees and professionals a compensation package that includes base salary and an annual bonus. While the base salary may be competitive, and the annual bonus may be based on short-term financial goals and/or personal objectives, the overall package does not provide a balanced combination of short-term and long-term incentives and benefits that is distinguishable from the plans offered by competitors.

In contrast, most “Fortune 1000” companies provide a total rewards package that includes:

- Competitive base salary

- Coordinated short-term and long-term incentive compensation arrangements designed to align the interests of key employees and professional with those of shareholders and,

- A comprehensive benefits package

Phantom Equity Component of the Package

Employee ownership is commonplace in the U.S. Studies indicate that more than 20% of the workforce owns stock in its employer through stock options, restricted stock plans, ESOPs, stock purchase plans, or in a 401(k) plan.

However, for many privately-held companies these plans may not be practical because of the current ownership structure, governance issues, or the cost of regulatory requirements. Some form of phantom equity arrangement may be more effective in meeting the shareholders objectives:

- Ensure the long-term financial success of the Company by improving its ability to attract and retain talented managers and professionals

- Align the interests of key employees / professionals and shareholders, and focus their attention on the long-term growth and appreciation of the business

- Develop a performance-based compensation culture by creating a direct line of sight between pay and performance

- Create an opportunity for key employees / professionals to share in the future appreciation of the Company they help create

- Send a clear message to the participants that the are a critical part of the leadership team, and their performance is what will drive that value creation.

- Maintain sufficient flexibility to handle change (which is sure to come)

Current Trends in the Private Company Market

EBS works with its clients to consider a range of possible solutions to executive benefit needs / issues.

Depending on the corporate structure, the company’s tax position, the objectives of the plan sponsor and the needs of the participants there may be interest in:

- A traditional pre-tax non-qualified deferred compensation plan

- A split dollar or other life insurance-based program

- And/or a phantom equity plan.

In addition, we see a number of privately held companies that are considering a sale of the business or perhaps a transfer to the next generation of family. Planning for the retention of key employees through the sale / transfer may be critical to maximizing value of the owners’ business interests.

Planning / Sales Concepts

Many privately-held companies are interested in providing a supplemental tax-advantaged savings program for key employees that also includes the option for performance-based company contributions.

The plan could take the form of a traditional pre-tax deferral program or, depending on the corporate structure and tax position of the company and the owners, a life insurance-based arrangement.

In addition, we see very strong interest today among privately-held businesses in phantom equity arrangements that align the interests of shareholders and key employees by creating an opportunity for them to share in the growth and appreciation of the business.

Case Studies

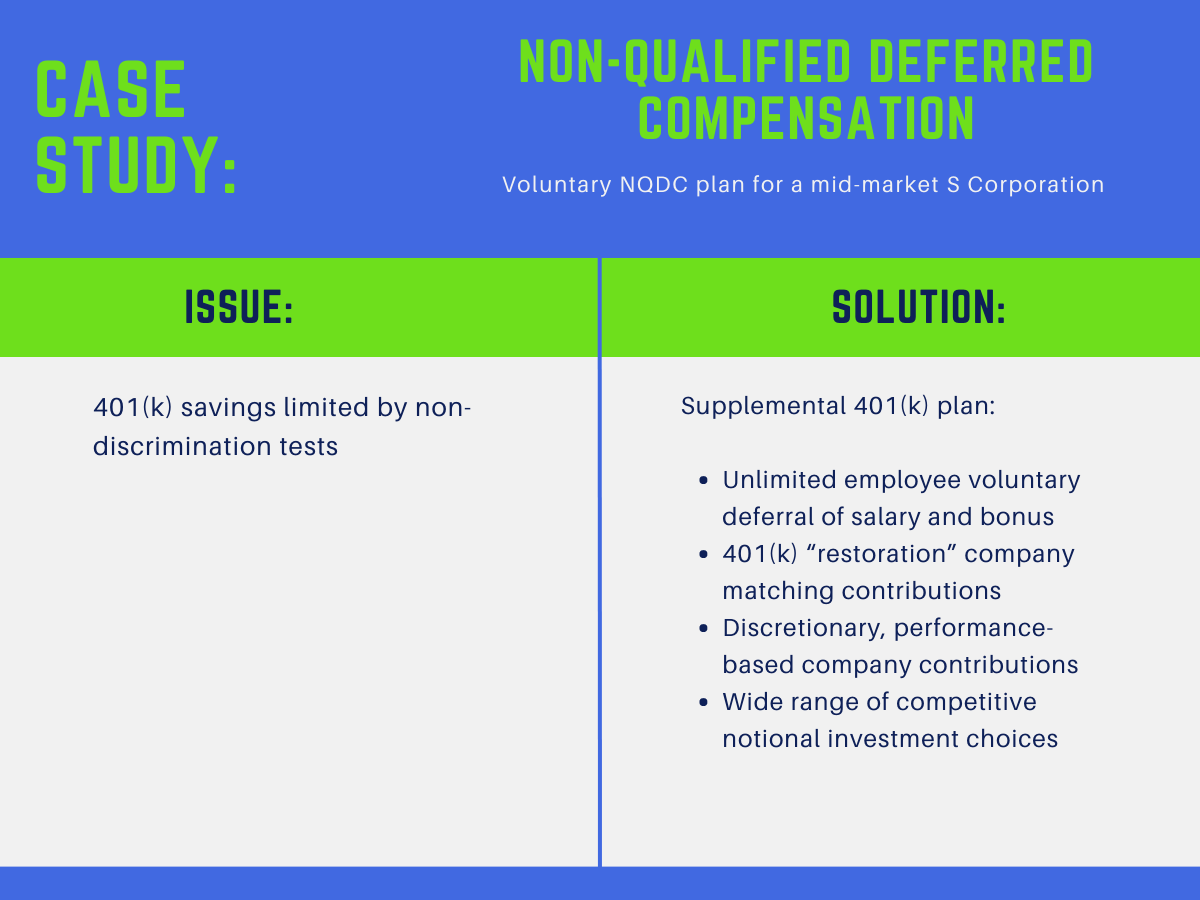

Non-Qualified Deferred Compensation

Voluntary NQDC plan for a mid-market S Corporation

The key employees of this company were interested in options for tax-advantaged savings beyond what was offered under the 401(k) plan. We designed a non-qualified deferred compensation program that met that need on a cost-effective basis to the company.

One interesting note is that it is an S Corporation, for which the conventional thinking is that a pre-tax deferral program doesn’t work well because of the negative tax impact on the shareholders. We completed extensive financial modeling to clarify that impact, which ultimately was determined not to present a problem to the owners.

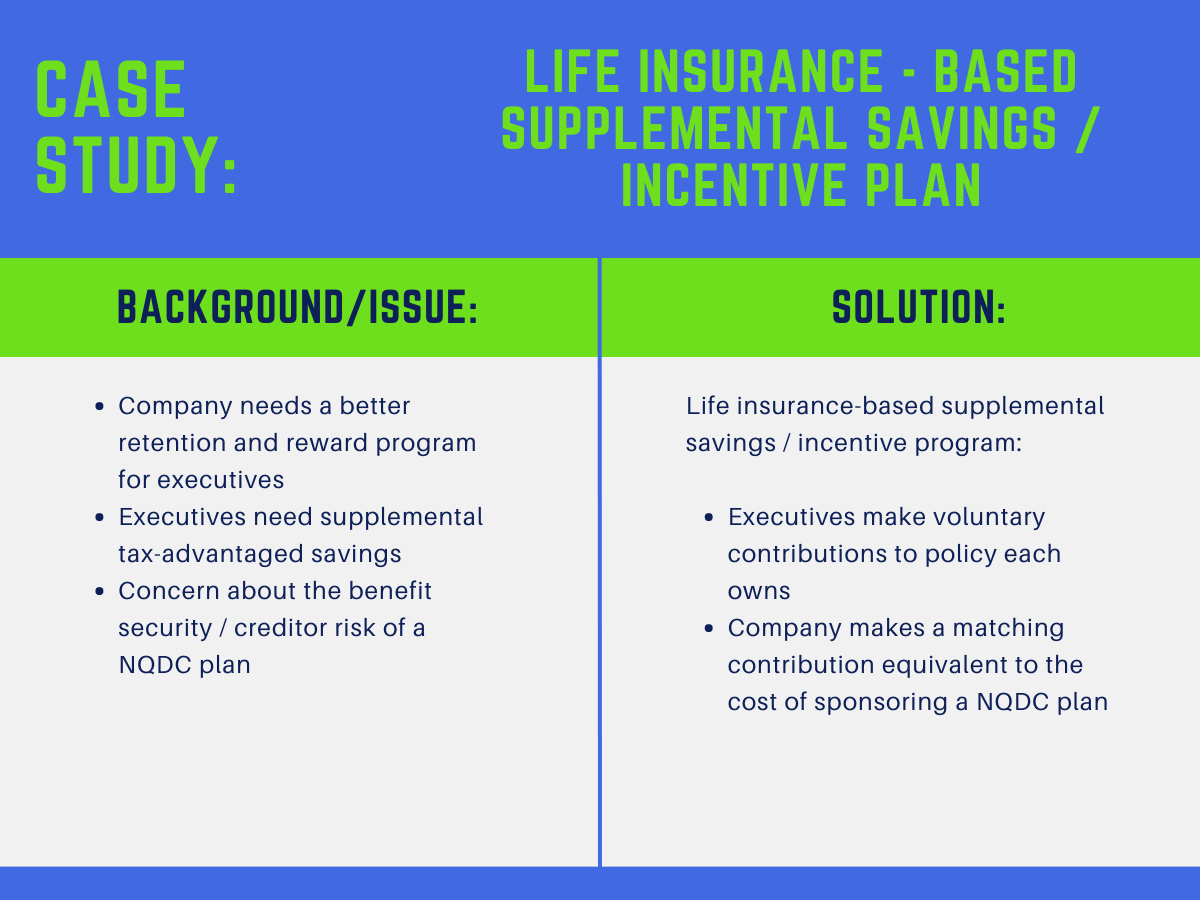

Life Insurance – Based Supplemental Savings / Incentive Plan

In this case, the key executives were also looking for a supplemental tax-advantaged savings program, but were not interested in a traditional non-qualified deferred compensation plan because of concerns about creditor risk.

EBS custom designed a life insurance-based program that included a matching contribution that is of comparable cost to the company of sponsoring a NQDC plan.

Once again, the detailed analytics provided by EBS was the key to deciding to move forward with this solution.

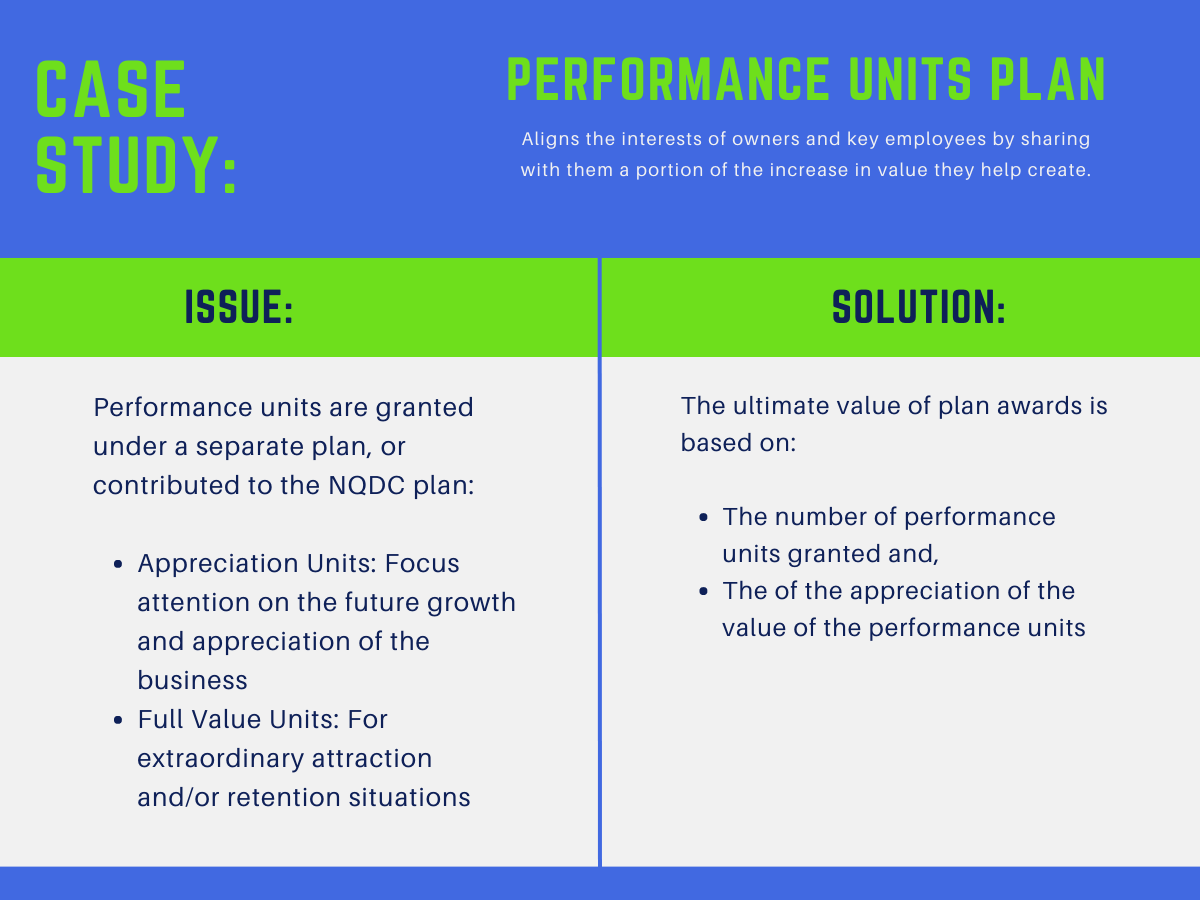

Phantom Equity Plan:

Performance Units Plan

We see strong interest today among privately-held businesses in phantom equity arrangements that align the interests of shareholders and key employees by creating an opportunity for them to share in the growth and appreciation of the business.

In this case a performance units plan was designed to meet the specific goals and objectives of the client.

The plan has been very successful and improved the company’s ability to attract and retain key employees.

Disclosure: No case study is used to imply future performance. The case studies are intended to illustrate services available through the adviser. They do not necessarily represent the experience of any clients.

About EBS

EBS principals and Managing Directors each have over 25 years of experience working with a wide range of clients including publicly-traded companies, privately-held businesses, professional firms and non-profit organizations

Exclusive Focus

EBS is not involved in any other business. It is exclusively focused on the executive benefit market.

Operations

EBS works with clients around the country. Its technical support team is located in Boston, and the Client Service Center is located in Dallas.

Markets

EBS works with a wide range of clients including; publicly-traded companies, privately-held business, financial institutions, professional firms and non-profit organizations.

Approach

Our consultative approach is what distinguishes EBS from its competitors. We work collaboratively with clients to help them better attract, retain and appropriately compensate key employees and professionals.

Process

The EBS planning process is consultative in nature. We work with the client to ensure that we have a complete understanding of the facts, the plan sponsor’s objectives, the needs of participants, and any specific design restrictions.

The plan design process is supported by extensive financial modeling with respect to the potential benefits for participants and cost to the sponsor.

We assist with each step of the implementation process and provide long-term plan administration and technical support.