Executive Stock Compensation: Rethinking LTIP Design for Greater Flexibility, Effectiveness, and Value.

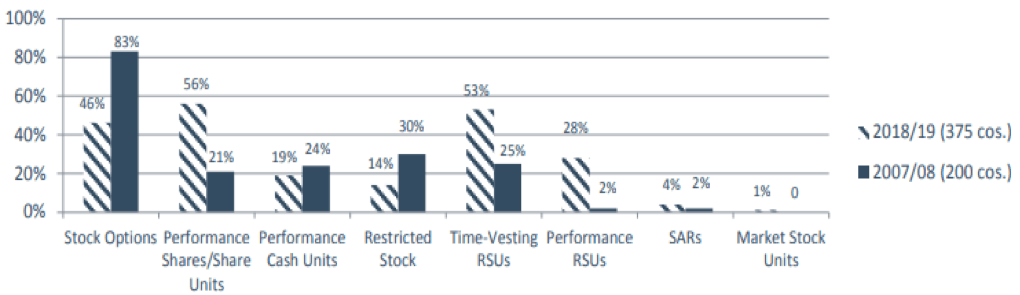

In the first of our four-part series on Executive Stock Compensation we noted the trend in Long-Term Incentive Plan design from a significant reliance on stock options to a portfolio approach using a mix of equity incentives including Restricted Stock Awards (RSAs), Restricted Stock Units (RSUs), Performance Shares and Performance Stock Units (PSUs).

In this second blog in the series, we highlight the advantages of RSUs and PSUs, and focus on one of the most important— the opportunity for tax deferral.

A Meaningful Trend

Stock compensation issued under a Long-Term Incentive Plan typically represents the most significant portion of the total rewards package for senior corporate executives. Ayco, a Goldman Sachs company, recently surveyed 375 client companies, in an update to earlier surveys, to understand the extent to which employers rely on LTIP awards.

In the chart below, notice the trend to an increasing emphasis on RSUs and PSUs over the last ten years as the prevalence of the use of stock options declined.

Why did this happen? As you may know, fifteen years ago, the Financial Accounting Standards Board began requiring companies to recognize an accounting expense for stock options issued which, in effect, leveled the equity playing field. As a result of the issuance of FASB Statement 123R (later incorporated into ASC Topic 718), many publicly-traded companies shifted from a concentration on the use of stock options to a portfolio approach to executive compensation planning including a range of equity incentives. Today, the use of RSUs and PSUs dominate many executive total rewards packages because of the flexibility of plan design, the tax advantages and the relative ease of administration.

The Advantages of RSUs / PSUs

In comparison to other forms of equity LTIP awards, the use of RSUs and PSUs provide a number of advantages, including:

- Greater flexibility of plan design:

- For example, PSUs offer a greater range of potential value. Subject to the achievement of specific performance criteria, grants often range from 0% to 200% of target, which may provide a more appropriate balance of retention and performance.

- Secondly, it is possible to separately determine the timing of vesting and of distribution. This action could avoid the triggering of taxation upon eligibility for retirement rather than at actual retirement, if there is accelerated vesting upon eligibility for retirement.

- Potential tax benefits: If the LTIP is coordinated with a deferred compensation plan, executive participants may be able to:

- Regain control over the timing of taxation they once had with stock options

- Elect to defer certain grants after the date of grant (explained more fully below)

- Manage the timing of distributions to meets savings needs

- Possibly realize state income tax savings, if they were to move in retirement to a state with a lower tax rate than the state in which the compensation was earned

- Meet share ownership requirements more easily

- Diversify net worth, from an over-weighted concentration of assets linked to share price

- Simplified stock administration: Since no shares are issued at the time of grant, share administration is simplified if performance targets or time vesting requirements are not met.

In summary, the use of RSUs and PSUs offers greater flexibility for the plan sponsor to design an equity incentive program with an appropriate mix of performance and retention incentives, and greater perceived value to participants.

The Advantage of Tax Deferral – A Hypothetical Example

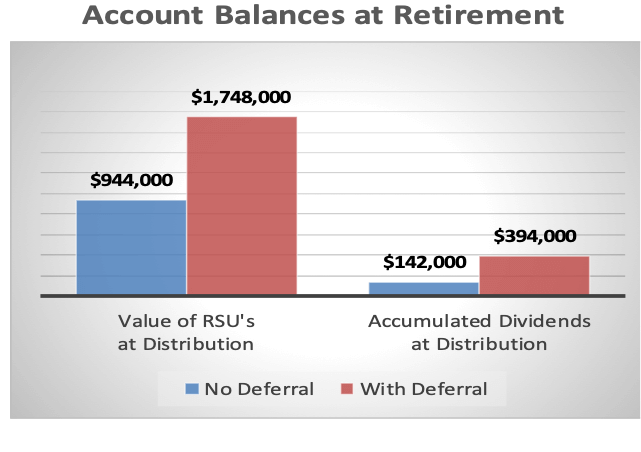

EBS has developed an RSU Modeler to quickly estimate the potential advantage of tax deferral. The example below illustrates the potential increase in value at retirement, and the projected increase in after-tax retirement income with and without tax deferral. The analysis reflects the following assumptions for one sample executive participant in an RSU plan:

- Current age: 55

- Expected age at retirement: 65

- Grant: 50,000 RSUs on 3/1/2020

- Vesting: 12,500 units per year for 4 years on the anniversary of the date of grant

- Elected distribution of benefits: 10 annual installments beginning at retirement

- Share price at the date of grant: $20.00

- Expected annual appreciation: 6.0%

- Annual dividend: 3.00%

- Executive combined federal and state income tax rate: 45% / Capital Gains tax rate: 28%

- Medicare tax upon vesting: 2.35%

Projected Value at Retirement

Based on the above assumptions, the projected value of the RSUs at retirement with and without deferral is illustrated below. In the no-deferral case, the key differentiating factor comes from the sale of 45% of RSUs at vesting to cover taxes which, in turn, reduces the dividends received.

However, note that without deferral, while nearly one-half of the shares are sold to pay taxes, the subsequent sale of the remaining units at retirement would be subject to lower capital gains taxes.

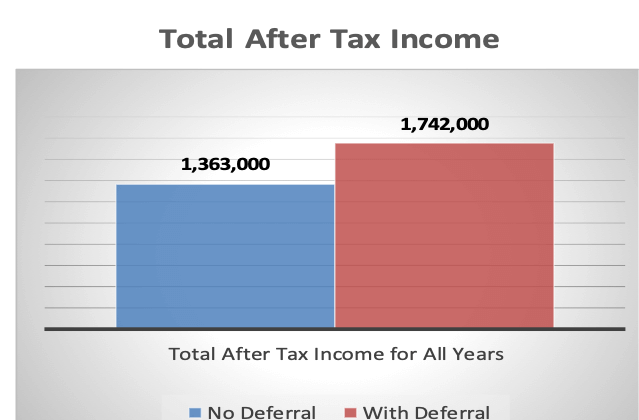

Projected Retirement Income

Based on the projected value of the RSUs at retirement above, the projected after-tax retirement income over 10 years is illustrated in the bar graph below:

In summary, this hypothetic analysis illustrates the structural advantage of tax-deferred accumulation. The executive can control the timing of taxation through management of distributions from the Deferred Compensation Plan and may even be able to avoid or reduce state income taxes, in the event that he/she moves in retirement to a state with a lower income tax rate (that potential tax savings is not included in the above projections).

Management of Distributions from the Deferred Compensation Plan

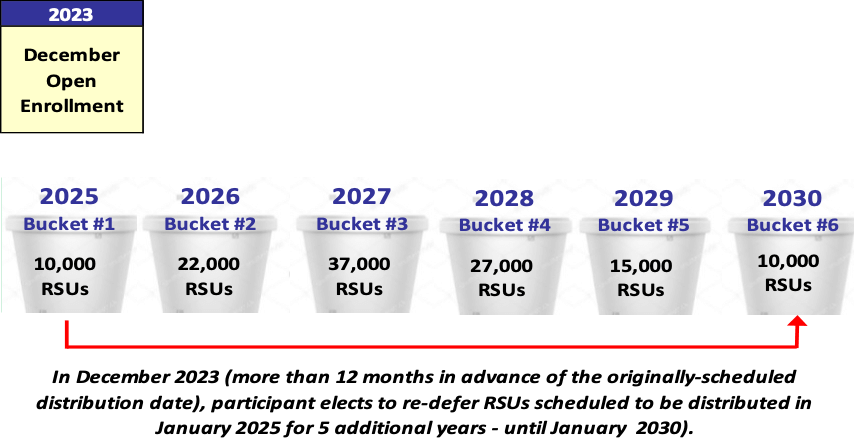

One of the more flexible features of a deferred compensation plan (briefly mentioned above), is the ability to re-defer a scheduled distribution. For example, assume an executive has established an In-Service Distribution Account scheduled to be paid out on January 1, 2023. The executive can change the payment date of that In-Service Distribution account, as long as:

- The election to change is made at least 12 months prior to the current distribution date,

- The new distribution date is at least 5 years later than the current distribution date and,

- The change election does not take effect for at least 12 months.

By using this “subsequent deferral” rule under Section 409A, a participant can actively manage distributions to meet his or her savings needs and, at the same time, mitigate creditor risk.

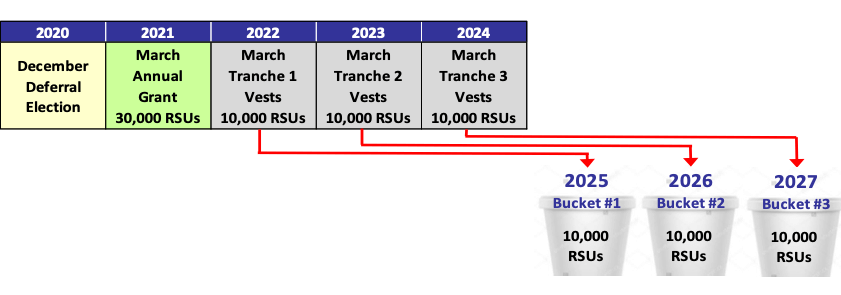

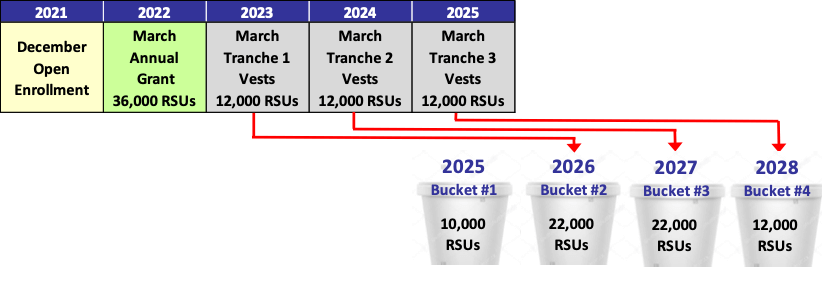

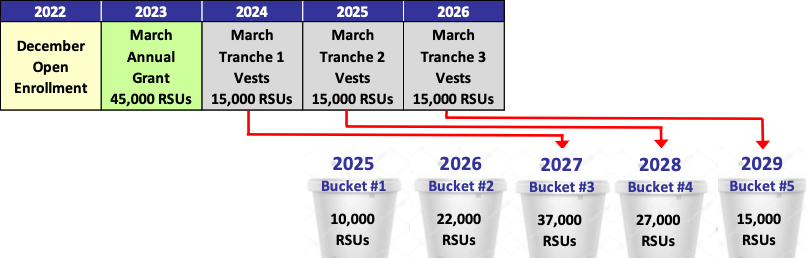

The following series of graphics illustrate the ability to allocate deferred compensation to multiple In-Service Distribution “buckets,” and then re-defer (or extend the period of deferral) from one In-Service Distribution bucket to another with a later distribution date (as long as the distribution change rules outlined above are closely followed).

STEP 1

Allocate compensation deferred to an In-Service Distribution bucket three years out (the minimum deferral period under the plan)

2021 Grant

2022 Grant

2023 Grant

STEP 2

At any time more than 12 months prior to the originally-scheduled 2025 distribution date, make a subsequent deferral election to re-defer the balance in that bucket to a 2030 in-service distribution bucket.

In summary, through active management of the distributions from the Deferred Compensation Plan, you have the flexibility to meet both your long-term and short-term savings needs while mitigating the exposure to creditor risk.

Electing to Defer an RSU / PSU Grant Made in a Previous Year

The general rule for the timing of an election to defer compensation under Section 409A is referred to as the “year before the year” rule. In the case of RSUs and PSUs, this means that an election to defer must be made in the year before the year of grant.

However, as is always the case, there are exceptions to the general rule. One of those exceptions permits an election to defer a grant of RSUs and/or PSUs anytime more than 12 months prior to the vesting date. For example, if a grant of 10,000 RSUs is made in March 2020 and the grant will vest ratably over four years, an election to defer the second, third and fourth vesting tranches could be made in December 2020, since those tranches are scheduled to vest March 2022, 2023 and 2024. This option can be extremely valuable.

Our firm has occasionally been asked for assistance with the implementation of a Deferred Compensation Plan after the hiring of a new senior executive who has received a significant grant of RSUs at the time of hire. Conventional thinking states that it is too late to elect to defer a grant already made. However, conventional thinking may be incorrect.

Summary

The many advantages of the use of RSUs and PSUs in comparison to other forms of equity awards do not come without some important considerations:

- Creditor risk inherent in a non-qualified deferred compensation plan,

- Loss of the opportunity for capital gain treatment for post-vesting appreciation,

- Loss of the opportunity to make a Section 83(b) election (which may be good news or bad news),

- Lack of shareholder voting rights and,

- No actual payment of dividends (although dividend equivalents are often credited on vested and deferred shares).

However, in most cases, the enhancement in value of the LTIP though coordination with a state-of-the-art deferred compensation plan, far outweighs any potential disadvantages.

Upcoming Blogs in the, Add Flexibility and Value to Long-Term Incentive Plans Through Deferral and Diversification of RSUs, series:

Part III

In Part III of our Add Flexibility and Value to Long-Term Incentive Plans Through Deferral and Diversification of RSUs Series of blogs, we will address the issue of diversification; that is, the ability of a participant to reallocate some or all of his or her deferred compensation account balance denominated in RSUs and PSUs to other notional investment choices offered under the plan (such as an S&P 500 fund).

Notwithstanding the potential benefit to participants, diversification is rarely offered because of a presumption that it will lead to negative accounting treatment and/or because it conflicts with a fundamental LTIP design principle to align the interests of senior management with shareholders. However, it may be possible to implement a plan that permits diversification in a manner that addresses both the accounting and plan design issues.

Part IV

In Part IV, we will discuss the steps involved in the implementation and administration of a deferred compensation plan that offers the deferral and diversification of RSUs and PSUs.

We look forward to continuing the dialogue,

The Managing Directors of EBS