Executive Stock Wealth in the Age of Distraction: Time to Reexamine Your Equity Compensation Plan

Few would disagree that we live in the age of distraction, interruption, and the unexpected. Ask any CFO.

No longer spreadsheet crunchers, today’s CFO doubles as strategic thinker and partner to the CEO, coping with broader responsibilities and divided attention spans.

On top of the US-China trade war and Federal Reserve monetary policy, CFOs worry about a looming recession. Fortunately, “80 percent of CFOs expect any downturn to be mild—an indication that companies are prepared to face the challenges ahead,” says Sanford Cockrell III, national managing partner of the U.S. Chief Financial Officer Program, Deloitte LLP.

Even so, with three generations in the workplace, CFOs also find themselves deeply involved in human resource utilization and challenged to find, retain, and reward the right talent.

Amid crammed schedules and spreading responsibility, how much can the average CFO know about the complexity of executive benefits, let alone the inner workings of an equity compensation plan?

So we ask, can you maximize equity compensation plans to attract coveted talent, grow retirement assets, reduce high taxes, and incentivize long-term performance?

Find the answers in our new four-part series, Add Flexibility and Value to Long-Term Incentive Plans Through Deferral and Diversification of RSUs.

In our series, EBS will share valuable and actionable facts and analyses on the shift from stock options and restricted stock to restricted stock units (RSUs) and performance stock units (PSUs).

Learn about these wealth-building tools and their pros and cons in an equity compensation plan. Understand how they fit into your long-term incentive plan (LTIP).

Once informed, you can decide if a RSU/PSU deferral and diversification program serves the goals of your C-suite, then you’ll be ready to step into the mechanics of program implementation and maintenance.

We intend to challenge conventional thinking.

And at the end of our series, we believe you’ll think differently, too.

Inflection Point

Back in late 2004, the Financial Accounting Standards Board put out a statement that required companies to book an accounting expense for stock options issued, leveling the equity playing field.

Once preferred, stock options became entangled with scandals, so companies began to turn to other types of stock awards as recruitment leverage.

RSUs, usually reserved for top management, were granted to all levels of employees, and stock option grants by Fortune 1000 firms declined by 40 percent between 2003 and 2005, while RSUs increased by nearly 41 percent over the same period, cites Investopedia.

Widespread Trend

Stock continues as the largest component in equity compensation plans, increasing 10.2 percent in value from 2017, which accounts for 51.2 percent of total median pay, according to Equilar. However, plan design of executive compensation in the last decade shifted from stock options to a primary emphasis on RSUs and PSUs.

In fact, the percentage of Equilar 500 CEOs receiving performance-based awards has steadily risen, passing both time-based stock and options grants as the most prevalent long-term incentive vehicle. In 2018, 87.8 percent of Equilar 500 CEOs received performance-based awards.*

RSUs Double in Usage

In another look at the RSU/PSU trend, a comprehensive 2017 study of 325 companies by The Ayco Company reports 72 percent of respondents use RSUs in their long-term incentive compensation programs compared to only 37 percent a decade ago. The use of restricted stock fell to 13 percent in 2017, down from 41 percent in 2007, according to Ayco.

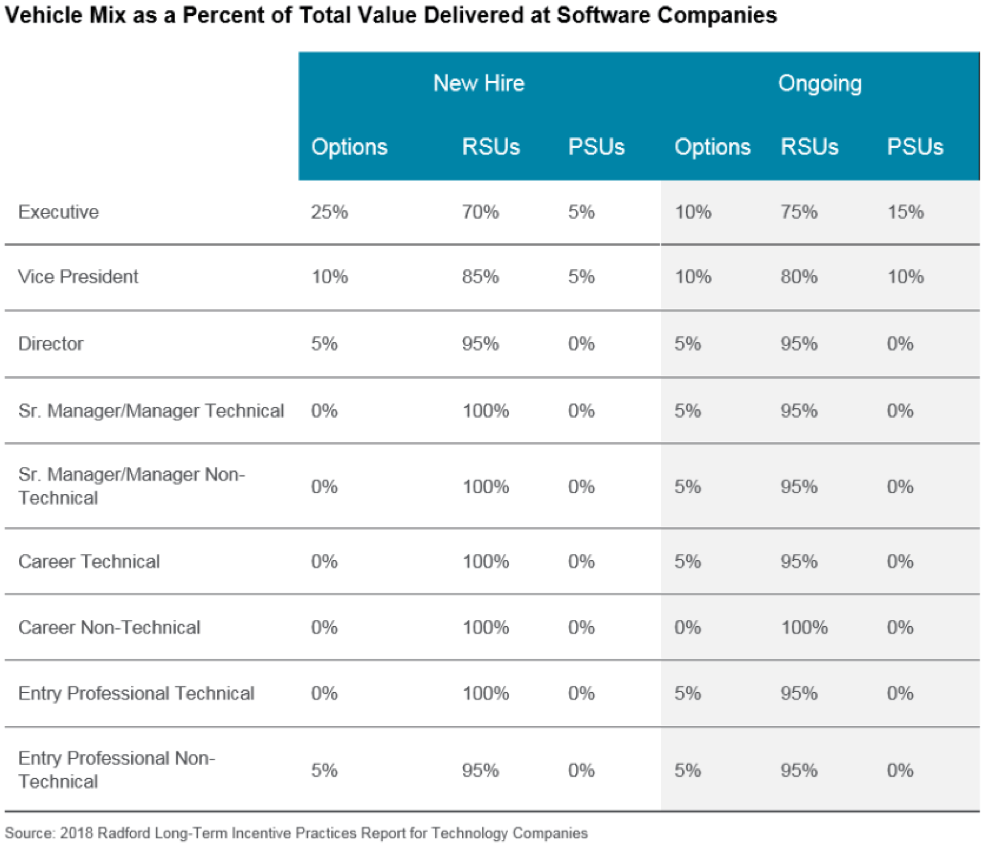

To gain a clear sense of how these forms of equity compensation breakdown comparatively, we highlight the software industry in the chart below to underscore the growth of RSUs/PSUs in 2018:

*The Equilar 500 index comprises the largest US-based companies, by revenue trading, on one of the major U.S. stock exchanges.

*The Equilar 500 index comprises the largest US-based companies, by revenue trading, on one of the major U.S. stock exchanges.

As stock options gave way to the popularity of RSUs and PSUs, a new set of questions arose for executive participants in deferred compensation plans:

- Do I defer or not?

- What about vesting?

- Can I diversify into other investments?

- How will my decision impact tax liabilities?

In our series, CFOs and plan sponsors will learn the answers to these questions. Better still, we’ll share our methodology for deferring and diversifying RSUs/PSUs as an LTIP feature while, at the same time, maintaining your P&L stability.

Look for part two of our blog series in a few weeks when we deep dive into the full wealth-building potential of restricted and performance stock units. Meanwhile, please contact us if you need immediate support.

From the Managing Directors of EBS