What is Split Dollar Life Insurance?

Are you a nonprofit organization?

If yes:

1. How many times have you lost your top talent to for profit organizations?

and

2. When they left, how long did it take you to replace them?

If you answered:

- More than once.

- A long time, with a few compromises.

You’re not alone.

Far too often we have clients come to us after experiencing exactly this. An inability to stop employees from leaving for the for-profit world.

But why?

Simply put, the structure of a nonprofit doesn’t allow for companies to provide equity to their executives as a form of compensation. Instead, the nonprofit organizations rely heavily on the mission and the passion of top talent as their best form of retention.

There is a powerful tool to consider in your quest to retain key employees.

You can reduce turnover by implementing a split dollar life insurance program. Trust us, we’ve been doing this since the early 90’s. A split dollar life insurance program can provide key employees with an attractive benefit funded by the organization with the retention characteristics that encourage them to stay put.

Not only that, it’s flexible and cost effective.

So what exactly is split dollar life insurance anyways? Below are the basics, which we took from our detailed white paper. You can download it here.

- Split-dollar life insurance isn’t a form of life insurance product, like term life insurance, whole life or universal life insurance; it is a form of ownership of cash value life insurance.

- Split-dollar is a strategy that allows the sharing of the cost and benefits of a cash value life insurance policy. Any type of permanent life insurance policy that builds a cash value can be used; however, the type of policy and structure is very important and should be tailored to the objectives of the organization and the needs of the executive/professional (i.e., retirement income, death benefits, etc.).

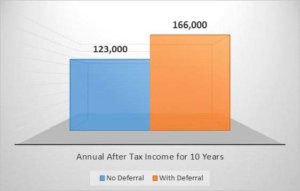

- Split-dollar brings together the life insurance and supplemental savings needs of an employee with the premium paying ability of the employer. It appeals to both employers and employees: the employee gets the life insurance protection he/she needs at an affordable cost and supplemental tax-advantaged savings in the form of cash value accumulation. The employer can custom design a program for selected key employees/professionals and provide a valuable benefit on a cost-effective basis. Historically, what has made split-dollar attractive is the opportunity for both tax leverage and interest rate arbitrage.

Want more? We made a video that discusses the use of a split dollar program at nonprofit organizations – you can watch here.

If you’re a nonprofit and you’re looking to attract, retain, and reward your key executives – give us a call at 617.904.9444 or drop us a line at info@executivebenefitsolutions.com

Disclosure: A variety of life insurance products can be used for this split dollar concept, including variable life insurance, which is offered by prospectus. Securities offered through Lion Street Financial, LLC. (LSF), member FINRA & SIPC. LSF is not affiliated with EBS and neither LSF nor EBS provide legal or tax advice. Complex tax rules apply for split dollar arrangements. For complete details, consult with your tax advisor and attorney.