Best of 2020: Restricted Stock and More

A new year means new content! While we get started on 2021’s concepts, take a look at our top three downloads from 2020. It’s always helpful for us to see what our readers enjoy the most, so that we can continue to create high quality materials to share with you all throughout the year. 2020’s hot topics included restricted stock, NQDC plans, and split dollar life insurance. Please as always, let us know if there’s anything you’re hoping to see from EBS in 2021. We look forward to creating and working with you this year.

This White Paper discusses the risks associated with participating in a Nonqualified Deferred Compensation Plan. It was written in 2018 by Bill MacDonald, Managing Director for EBS-West and remains one of our most downloaded content items every year.

Most companies that sponsor NQDC’s take measures to ensure funds are set aside to fund future benefits. Many firms establish rabbi trusts to hold these funds, which provides a measure of certainty that the funds won’t be used for purposes other than benefit payments.

But participant balances in NQDC’s are subject to creditor risk, and bankruptcy could result in a loss of the account. This White Paper discusses the Deferred Comp Protection Trust, a relatively new structure that protects against this risk.

If you’re interested in learning more on this topic, you may be interested in listening to a recorded webinar that features Brian Yolles, CEO of Stock Shield, the firm that created the Deferred Compensation Protection Trust.

When stock options gave way to the use of Restricted Stock Units (RSUs), recipients lost the ability to control the timing of taxation. Taxation of RSUs is triggered when vesting occurs, which is often on a prorated basis over the course of three or four years.

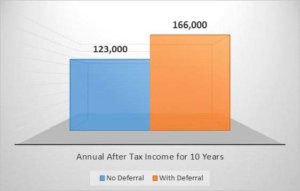

To regain control over the timing of taxation, some NQDC’s allow for the deferral of RSUs, in addition to cash compensation such as salary and bonuses, raising a number of questions for executives. Do I defer or not? What about vesting? Can I diversify into other investments? How will my decision impact tax liabilities?

This case study provides a methodology for answering these questions, and introduces the Restricted Stock Modeler created by EBS. Find out the pros and cons of deferring or not deferring your RSUs and how your action impacts your financial situation at retirement.

For a deeper dive into deferring Restricted Stock Units, take a look at EBS’ case study on creating a Restricted Stock Wealth Management Program (RS WMP). By using an NQDC’s short-term deferral account and the redeferral option, you can transform your annual RSU grants into a vigorous wealth-building strategy.

Recently, Nonprofit organizations have been bombarded by proposals to implement Split Dollar programs for their highly compensated executives. Why is this? Two major factors stand out: the 2017 Tax Cuts and Jobs Act imposed a new 21% excise tax on compensation paid by a Nonprofit organization in excess of $1 million; and the relative disadvantage of retirement programs for Nonprofit executives structured under Section 457(f).

This White Paper provides a comparison of Section 457(f) and Split Dollar plans, helping highlight the pros and cons of each. There is a handy matrix that presents a side-by-side summary of the two structures across a number of key features. The paper is helpful for Nonprofits that are trying to level the recruiting playing field with for profit entities in search of executive talent.

If you’re interested in learning more on this topic, take a look at A Practical Guide To Accounting For Loan Regime Split Dollar Arrangements. Written by EBS Managing Director Chris Rich (a former E&Y Tax Partner), it provides an overview of the accounting for split dollar arrangements.

That’s all for 2020. Be sure to follow our Twitter and LinkedIn to stay up to date with the latest content from EBS in 2021.