Executive Benefit Planning for Nonprofit Organizations 101

Key Takeaways from Compensation Conversations with EBS: Part 2

Building on the fundamentals shared in the first webinar of the four-part series, the second Compensation Conversations with EBS took a closer look at the nonprofit space.

Hosted by Christopher W. Rich, who was joined by Don Curristan and Chris Rich (all Managing Directors of EBS), this conversation leveraged case studies and industry expertise to outline the specific challenges as well as growing trends and opportunities for nonprofits. Find additional highlights below, then be sure to watch the recording!

Setting the Scene

As a leader in executive benefit planning, EBS knows that success starts with carefully and communally building a foundational understanding of the situation at hand. That’s why our conversation began with a thoughtful examination of key elements, including:

- The organizational needs of nonprofits as they seek to attract, retain and reward talented professionals

- The disadvantages nonprofits face when competing with for-profit companies

- The tax restrictions impacting the plan designs for nonprofits (e.g., Section 4960, Section 457(f), Section 409A, and the principle of reasonable compensation and intermediate sanctions)

- Traditional elements of Section 457(f) deferred compensation plans utilized by nonprofits

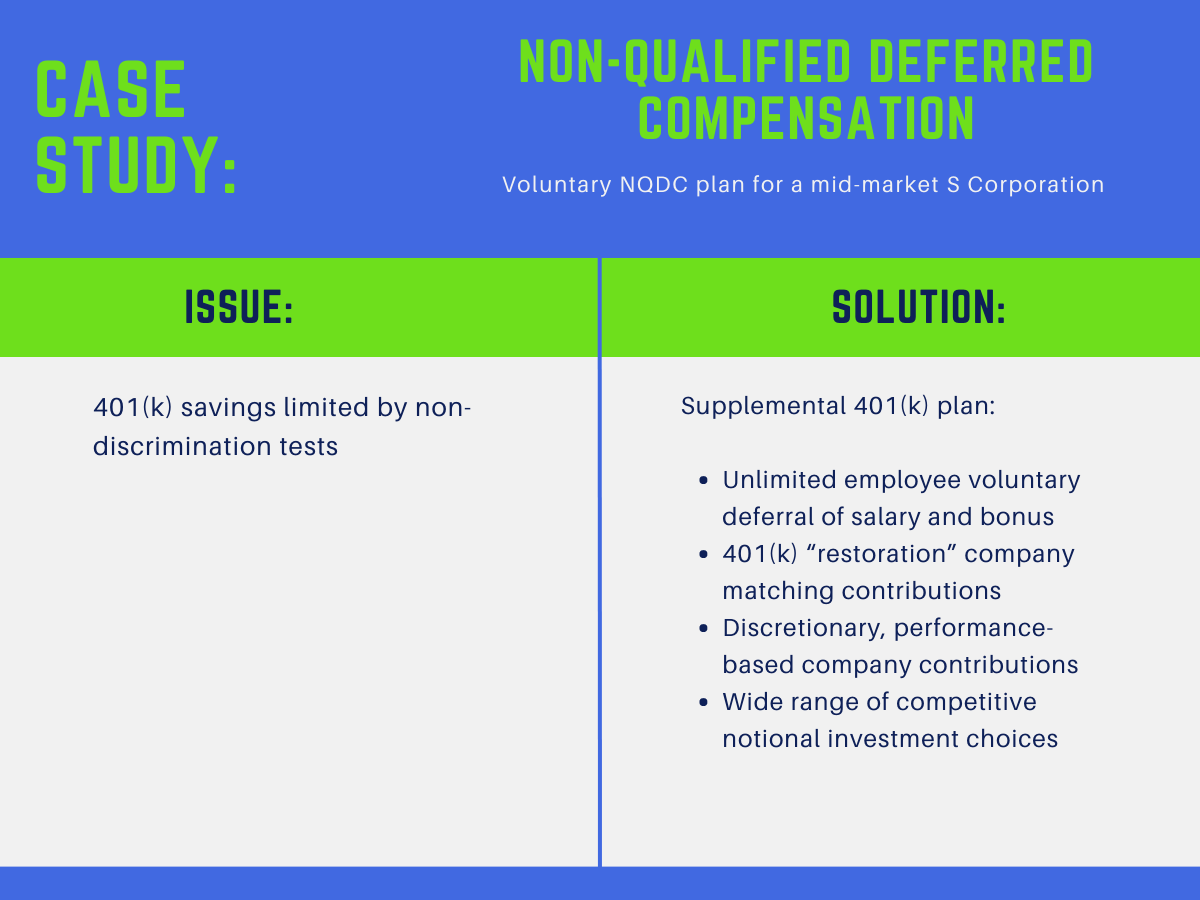

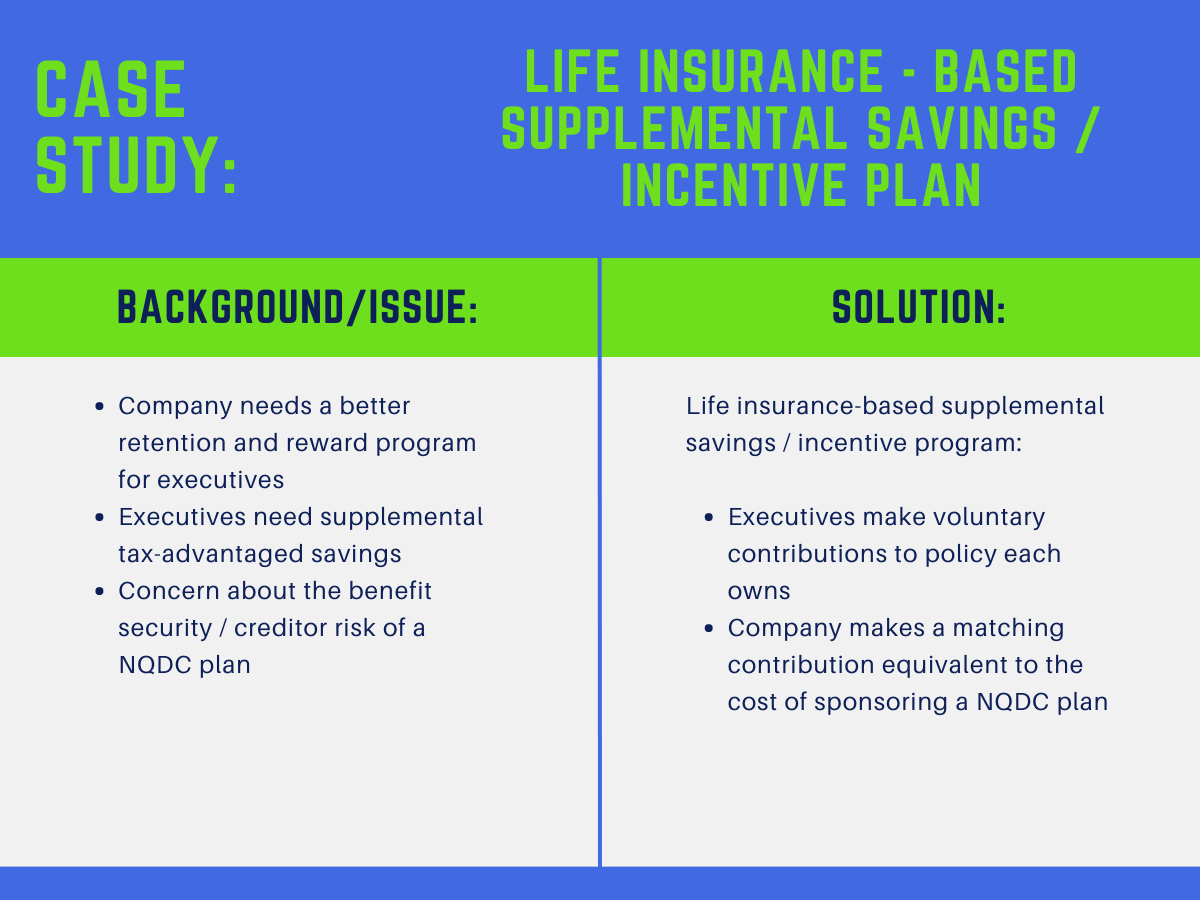

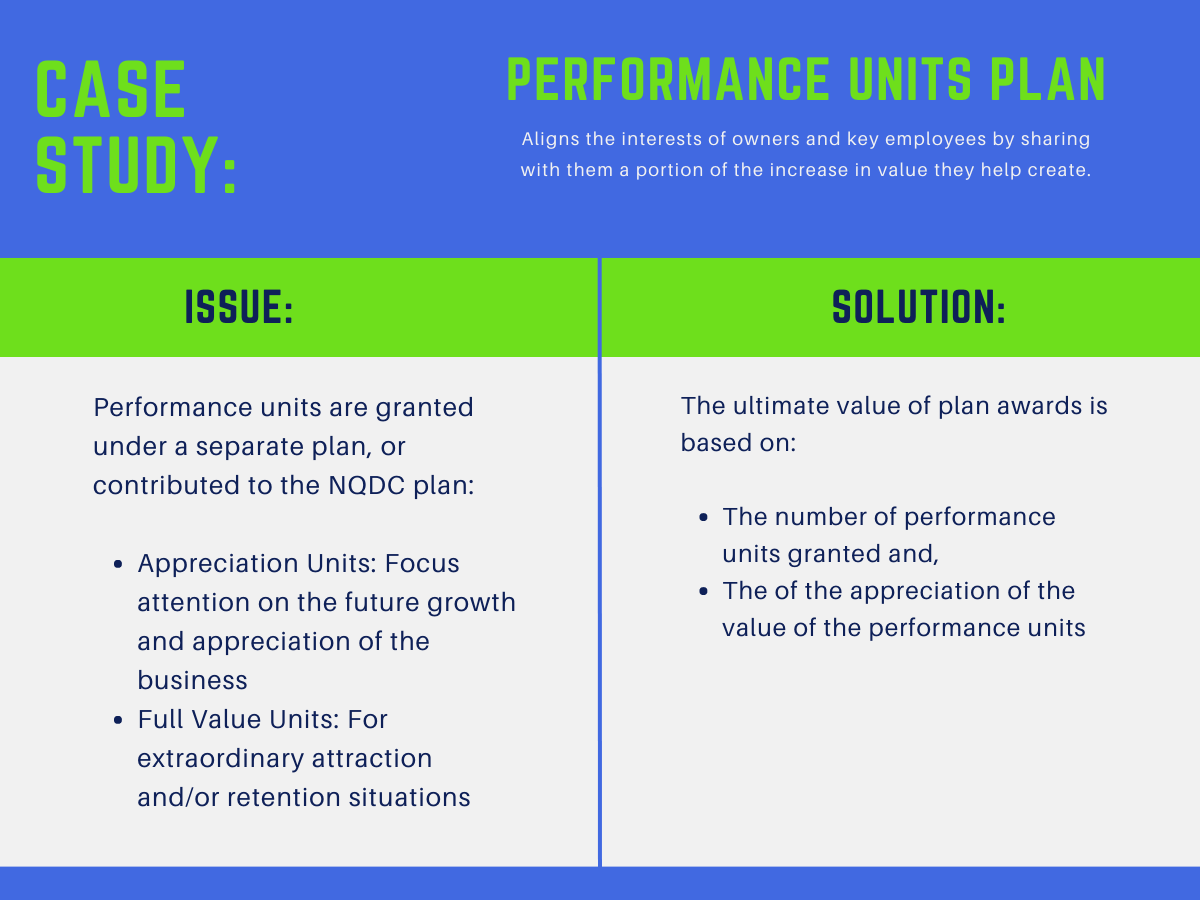

Alternative Solutions

Having identified the moving parts affecting nonprofit executive compensation, the team shifted to move beyond the limitations of Section 457(f) Deferred Compensation Plans. Diving into the life insurance-based alternatives, the conversation covered several designs and their best uses, including:

- Section 162 “Bonus” Plans

- Best use: Excess 403(b) / 401(k) plans for physicians

- Loan Regime Split Dollar (LRSD) Plans

- Best use: Alternative / supplement to Section 457(f) plan for healthcare executives, presidents and coaches of public colleges and universities and other highly compensated key employees of nonprofit organizations

- Salary Renegotiation LRSD Plans – EBS “TRIAD”

- Best use: Hospitals looking to reduce compensation expense and renegotiation of college coaches’ compensation packages

- Endorsement split dollar arrangements

- Best use: Retention plans (but generally subject to Section 457(f))

Final Thoughts

With a solid understanding of nonprofit tax implications, traditional deferred compensation options, and alternative solutions via life insurance-based plans, the conclusion was that all options should be considered. In closing the discussion, while noting that there is no perfect solution, the EBS team outlined:

- The pros and cons of both the traditional Section 457(f) SERP and life insurance-based alternatives

- A combination program including a 3–5-year Section 457(f) performance-based incentive plan and a long-term tax advantaged life insurance-based savings plan

- The sophisticated modeling capability of EBS to simultaneously illustrate the projected benefits to participants and the financial impact to the sponsoring organization

Be sure to watch the recording now and reach out by clicking the button below to partner with EBS.

About EBS

EBS principals and Managing Directors each have over 25 years of experience working with a wide range of clients including publicly-traded companies, privately-held businesses, professional firms and non-profit organizations

Exclusive Focus

EBS is not involved in any other business. It is exclusively focused on the executive benefit market.

Operations

EBS works with clients around the country. Its technical support team is located in Boston, and the Client Service Center is located in Dallas.

Markets

EBS works with a wide range of clients including; publicly-traded companies, privately-held business, financial institutions, professional firms and non-profit organizations.

Approach

Our consultative approach is what distinguishes EBS from its competitors. We work collaboratively with clients to help them better attract, retain and appropriately compensate key employees and professionals.

Process

The EBS planning process is consultative in nature. We work with the client to ensure that we have a complete understanding of the facts, the plan sponsor’s objectives, the needs of participants, and any specific design restrictions.

The plan design process is supported by extensive financial modeling with respect to the potential benefits for participants and cost to the sponsor.

We assist with each step of the implementation process and provide long-term plan administration and technical support.